Affordable insurance for plumbing, heating, and gas engineers.

Protect yourself and your livelihood with the right cover, at the right price.

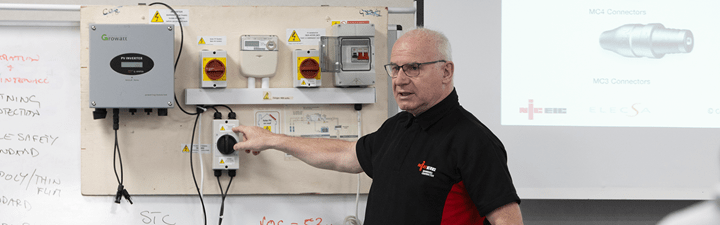

As a plumbing, heating or gas engineer, we understand the daily risks you face. If your work involves electrical jobs, you can access our exclusive, competitive and comprehensive electrical contractors insurance to protect yourself and your livelihood against these risks.

We're committed to protecting you and your business should the unthinkable happen. Working with a leading specialist insurer, we have negotiated high quality insurance at a competitive price for you.

If you become an NICEIC registered electrical contractor, you'll benefit from a 10% discount on the cost of your insurance.

Our comprehensive insurance cover for plumbing, heating, and gas engineers

By working with a specialist insurer, we've developed insurance with you in mind. It's comprehensive, flexible and affordable.

And, the best bit...

Registered NICEIC contractors get 10% off the cost of their electrical contractors insurance! *

We offer the following:**

-

Cover for contract works.

-

Cover for loss or damage to tools and office equipment.

-

Cover for temporary employees up to 50 days per year.

-

Cover for your own plant and hired in plant.

-

Employers liability cover of £10 million.

-

Free 24 hour business legal helpline.

-

Goods in transit.

The power behind your business

NICEIC Insurance services is here to help you with all your business insurance needs. From electrical contractor insurance, personal accident and short-term income protection to van insurance and premises insurance – we've got you covered.Unlike many direct insurers or comparison sites, we're here to provide expert advice. We'll explain the finer details of your plumbing insurance cover so you know exactly what you're protected for. This should give you peace of mind, leaving you to focus on looking after your customers.

Our support doesn't stop there. We're on-hand to guide you through the process of making changes to your cover – mid-term or at renewal, should your circumstances change. But, if you wish to do things yourself, our customer portal puts you in control. Download your documents, make adjustments and renew your policies online.

And, should the worst happen and you need to make a claim, we will help to make sure it's handled as quickly as possible.

Heating, plumbing, and gas engineers working in most situations can be covered across domestic, commercial and industrial premises in Great Britain, the Channel Islands, the Isle of Man, and Northern Ireland. Temporary work in the EU is also included as standard too.

*1 https://www.niceic-and-elecsa-insurance.com/news-and-information/niceic-and-elecsa-insurance-services-wins-an-exceptional-service-award/

https://www.feefo.com/en-GB/reviews/niceic-and-elecsa-insurance-services?displayFeedbackType=SERVICE&timeFrame=YEAR

*2 Cover may differ dependent upon insurer. As with most insurance – terms, conditions, and exclusions apply. You can request full details by simply contacting us.

Frequently asked questions

Thank you for your help and we really appreciate your efforts and support in getting the policy sorted. It was good to be able to speak to the same person every time and we felt you really understood our needs.

From NICEIC Customer